UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Sec. 240.14a-12 |

(Name of Registrant as specified in its Charter)

_________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

March 13, 202311, 2024

Dear Fellow Shareholder:

On behalf of the Board of Directors, we are pleased to invite you to attend our 20232024 annual meeting of shareholders, to be held at 8:00 a.m. Central Time on April 25, 2023,23, 2024, in the Auditorium of the First Horizon Building, 165 Madison Avenue, Memphis, Tennessee 38103.

In order to provide the proxy materials to our shareholders in an expedited manner while significantly lowering the costs of delivery and reducing the environmental impact of our annual meeting, we are furnishing these materials to shareholders on the internet at https://ir.firsthorizon.com/annual-reports/.www.proxydocs.com/FHN. You will receive a notice with instructions for accessing the materials and voting via the internet in addition to information about how to obtain paper copies of our proxy materials if you would prefer. Following this letter are the formal notice of the annual meeting and our 20232024 proxy statement. The proxy statement contains detailed information on the matters to be voted on at the annual meeting.

Your vote is important. We encourage you to vote your proxy by telephone or via the internet or, if you received a

paper proxy card by mail, you may also vote by signing, dating and returning it by mail. Even if you plan to attend the meeting, please vote your proxy as soon as possible.

In order to accommodate those attending, we ask that you let us know of your plans to attend by so indicating when you vote. Registration and seating will begin at 7:30 a.m. Central Time. We will ask you to sign in and present valid photo identification (or other identification acceptable to the company) as well as proof of ownership acceptable to the company, such as an appropriate brokerage statement. If you are the legal representative of a shareholder, also bring proof thereof.of that status as described on page 2 of this proxy statement. Cameras and recording devices will not be permitted at the meeting.

ThankAs we embark on our 160th year in business, we thank you for your continued support of First Horizon and for the trust and confidence you place in our company.

D. Bryan Jordan

Chairman of the Board, President and Chief Executive Officer

Notice of Annual Meeting of Shareholders

April 25, 202323, 2024

8:00 a.m. Central Time

The annual meeting of the holders of First Horizon Corporation’s common stock will be held at 8:00 a.m. Central Time on April 25, 202323, 2024, in the Auditorium of the First Horizon Building, 165 Madison Avenue, Memphis, Tennessee 38103.

The items of business are:

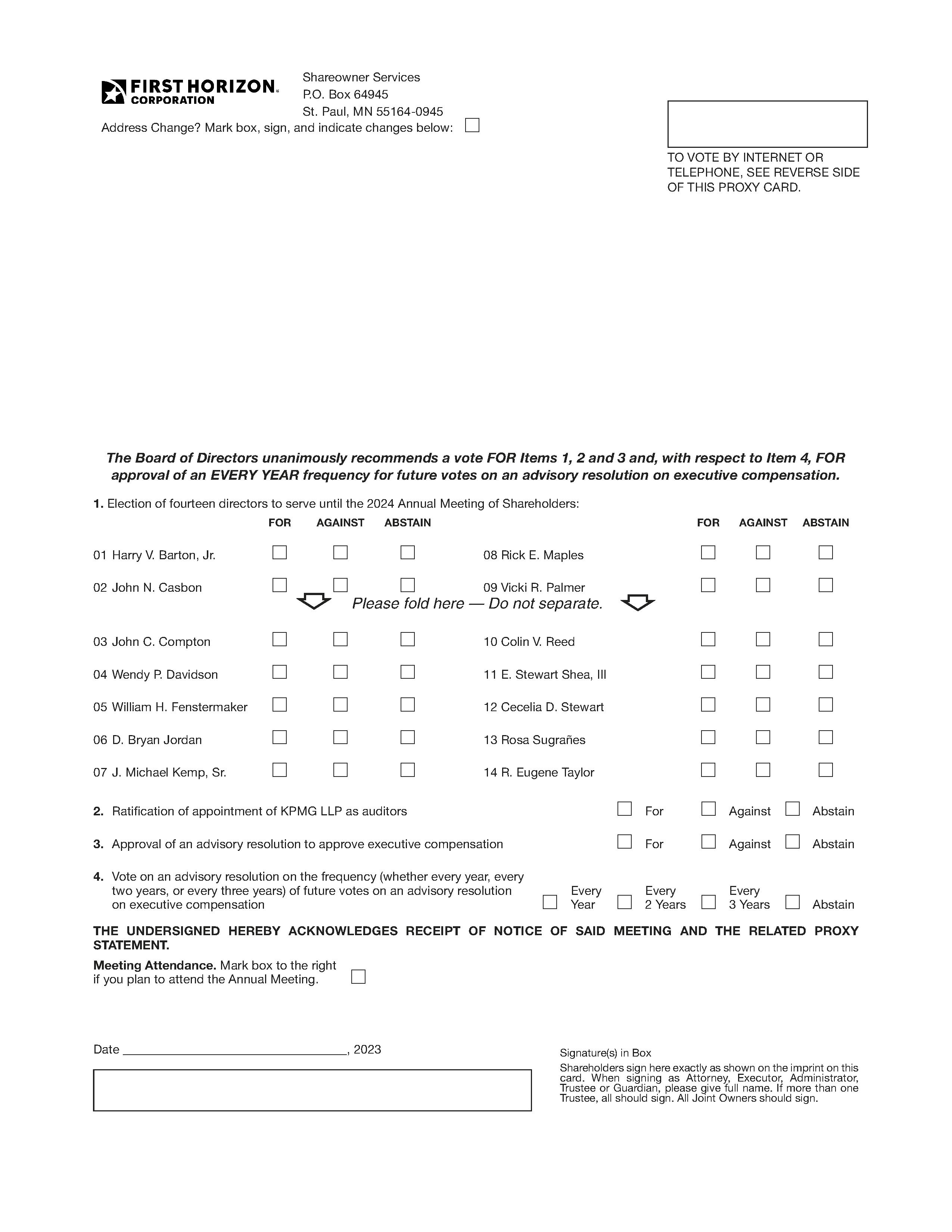

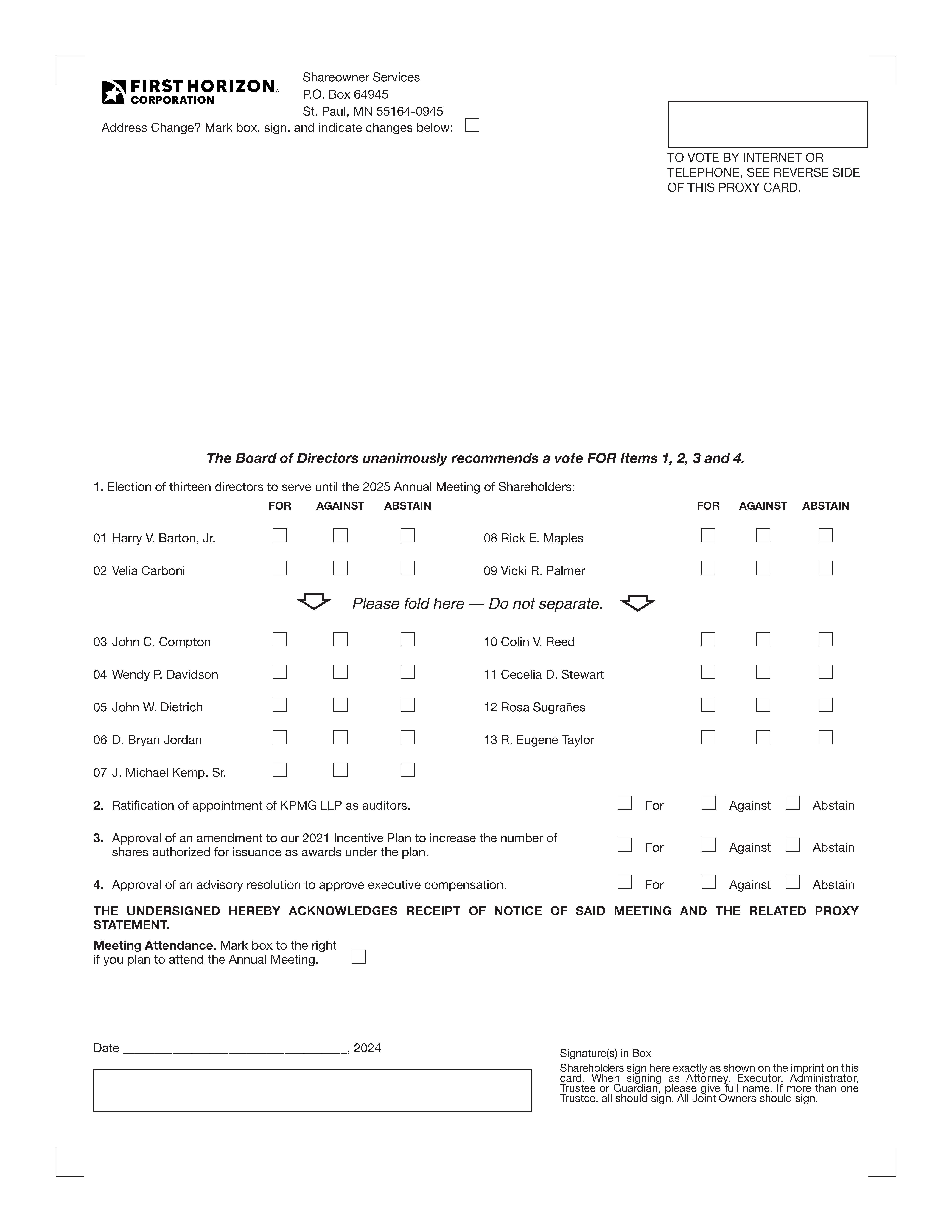

1. Election of 1413 directors to serve until the 20242025 annual meeting of shareholders and until their successors are duly elected and qualified.

2. Ratification of the appointment of auditors.

3. Approval of an amendment to our 2021 Incentive Plan to increase the number of shares authorized for issuance as awards under the plan.

4. Approval of an advisory resolution to approve executive compensation (“say on pay”).

4. Vote on an advisory proposal to determine the frequency (whether every year, every two years or every three years) of future say on pay votes.

These items are described more fully in the following pages, which are made a part of this notice. The close of business on February 24, 202323, 2024, is the record date for the meeting. All holders of record of First Horizon’s common stock as of that time are entitled to vote at the meeting.

On February 27, 2022, First Horizon entered into a merger agreement with The Toronto-Dominion Bank, a Canadian chartered bank (“TD”), pursuant to which First Horizon will be acquired by TD.Our shareholders approved the merger agreement at a special shareholders meeting held on May 31, 2022. No other action by our shareholders is required with respect to the pending TD acquisition. Accordingly, no action will be taken at the annual meeting with respect to, and no proxy is being solicited in connection with, the pending TD acquisition.If the pending TD acquisition is completed prior to the commencement of the annual meeting on April 25, 2023, the annual meeting will not be held.

As previously disclosed, on February 9, 2023, First Horizon and TD agreed to extend the outside date to May 27, 2023.Subsequent to the extension, TD recently informed First Horizon that TD does not expect that the necessary regulatory approvals will be received in time to complete the pending TD acquisition by May 27, 2023, and that TD cannot provide a new projected closing date at this time.TD has initiated discussions with First Horizon regarding a potential further extension of the outside date.There can be no assurance that an extension will ultimately be agreed or that TD will satisfy all regulatory requirements so that the regulatory approvals required to complete the pending TD acquisition will be received.

For more information on the merger agreement and the pending TD acquisition, please refer to First Horizon's filings with the SEC, including First Horizon's Annual Report on Form 10-K for the year ended December 31, 2022.

Management requests that you vote your proxy by telephone or over the internet or that you sign and return the form of proxy promptly, as applicable, so that if you are unable to attend the meeting your shares can nevertheless be voted. You may revoke a proxy at any time before it is exercised at the annual meeting in the manner described on page 67 of the proxy statement. Clyde A Billings, Jr.

Senior Vice President,

Assistant General Counsel

Counsel and Corporate Secretary

Memphis, Tennessee

March 13, 202311, 2024

| | |

IMPORTANT NOTICE Please (1) vote your proxy by telephone, (2) vote your proxy over the internet, or (3) mark, date, sign and promptly mail the form of proxy, as applicable, so that your shares will be represented at the meeting. If you hold your shares in street name, it is critical that you instruct your broker or bank how to vote if you want your vote to count in the election of directors, the approval of the amendment to the 2021 Incentive Plan, and the advisory resolution to approve executive compensation and the advisory resolution to determine the frequency of future say on pay votes (vote items 1, 3 and 4 of this proxy statement). Under current regulations, if you hold your shares in street name and you do not instruct your broker or bank how to vote in these matters, no votes will be cast on your behalf with respect to these matters. For additional information, see page 78 of the proxy statement. |

| | Proxy Summary | Proxy Summary | | | Vote Item 3—Say on Pay | | Proxy Summary | | | Vote Item 2—Auditor Ratification | |

| The Annual Meeting | The Annual Meeting | | | Say on Pay Vote Last Year | | The Annual Meeting | | | Appointment of Auditors for 2024 | |

| Vote Items | Vote Items | | | Alignment of Pay with Performance | | Vote Items | | | Auditor Fees Past Two Years | |

| ESG & Compensation Highlights | | | Say on Pay Resolution | |

| | Performance Highlights | | Performance Highlights | | | Pre-Approval Policy for Auditor's Services | |

| Corporate Responsibility & Compensation Highlights | |

| | | Vote Item 3—Approval of Am. to 2021 Inc. Plan | |

| | | Vote Item 3—Approval of Am. to 2021 Inc. Plan | |

| | | Vote Item 3—Approval of Am. to 2021 Inc. Plan | | |

| Annual Meeting Matters | Annual Meeting Matters | | | Vote Item 4--Advisory Resolution on Frequency of Say on Pay | |

| | | | Vote Item 4—Say on Pay | |

| | | Vote Item 4—Say on Pay | |

| | | Vote Item 4—Say on Pay | | |

| Culture & Governance | Culture & Governance | | | Compensation Discussion & Analysis | | Culture & Governance | | | Say on Pay Vote Last Year | |

| Our Firstpower Culture | Our Firstpower Culture | | | Executive Summary | | Our Firstpower Culture | | | Alignment of Pay with Performance | |

| Our Awards | Our Awards | | | CD&A Glossary | | Our Awards | | | Say on Pay Resolution | |

| Environmental, Social & Governance Matters | | | Pay Components & Decisions | |

| Corporate Responsibility | |

| Corporate Governance | Corporate Governance | | | Total Direct Compensation (TDC) | |

| Salary | |

| Corporate Governance | |

| Corporate Governance | | | | Compensation Discussion & Analysis | |

| | | CD&A Executive Summary | | | | | CD&A Executive Summary | |

| Board Matters | Board Matters | | | Incentive Mix | | Board Matters | | | CD&A Glossary | |

| Independence & Categorical Standards | Independence & Categorical Standards | | | Annual Cash Incentive | | Independence & Categorical Standards | | | Pay Components & Decisions | |

| Board Structure & Role in Risk Oversight | Board Structure & Role in Risk Oversight | | | Long-Term Incentive Awards | | Board Structure & Role in Risk Oversight | | | Total Direct Compensation (TDC) | |

| Board Committees | Board Committees | | | Compensation Practices & Philosophies | | Board Committees | | | Salary | |

| Committee Charters & Composition | Committee Charters & Composition | | | Peer Group & Market Benchmarking | | Committee Charters & Composition | | | Incentive Mix | |

| Audit Committee (incl'g Audit Committee Report) | | | Deferral, Retirement, & Other Benefits | |

| Compensation Committee (incl'g Compensation Committee Report) | | | Clawback Policy & Practices | |

| Audit Committee (incl'g Committee Report) | | Audit Committee (incl'g Committee Report) | | | Annual Cash Incentive | |

| Compensation Committee (incl'g Committee Report) | | Compensation Committee (incl'g Committee Report) | | | Long-Term Incentive Awards | |

| Executive Committee | Executive Committee | | | Compensation Governance & Other Practices | | Executive Committee | | | Compensation Practices & Philosophies | |

| Information Technology Committee | Information Technology Committee | | | Compensation Committee Report | | Information Technology Committee | | | Peer Group & Market Benchmarking | |

| Nominating & Corporate Governance Committee | Nominating & Corporate Governance Committee | | | Nominating & Corporate Governance Committee | | | Deferral, Retirement, & Other Benefits | |

| Risk Committee | Risk Committee | | | Recent Compensation | | Risk Committee | | | Clawback Policies & Practices | |

| Compensation Comm. Interlocks & Insider Participation | Compensation Comm. Interlocks & Insider Participation | | | Summary Compensation Table | | Compensation Comm. Interlocks & Insider Participation | | | Compensation Governance | |

| Director Meeting Attendance | Director Meeting Attendance | | | Grants of Plan-Based Awards | | Director Meeting Attendance | | | Compensation Committee Report | |

| Executive Sessions of the Board | Executive Sessions of the Board | | | Supplemental Compensation Disclosures | |

| Communication with the Board | Communication with the Board | | | Awards Outstanding at Year-End | |

| Awards Exercised & Vested | |

| Communication with the Board | |

| Communication with the Board | | | | Recent Compensation | |

| | | Summary Compensation Table | | | | | Summary Compensation Table | |

| Director Compensation | Director Compensation | | | Director Compensation | | | Grants of Plan-Based Awards | |

| Directors in 2022 | | | Post-Employment Compensation | |

| Directors in 2023 | | Directors in 2023 | | | Supplemental Compensation Disclosures | |

| Director Programs | Director Programs | | | Pension Plans | | Director Programs | | | Awards Outstanding at Year-End | |

| Director Compensation Table | Director Compensation Table | | | Nonqualified Deferred Compensation Plans | | Director Compensation Table | | | Awards Exercised & Vested | |

| Awards Outstanding at Year-End | Awards Outstanding at Year-End | | | Employment & Termination Arrangements | |

| Director Awards Exercised & Vested | Director Awards Exercised & Vested | | |

| Director Awards Exercised & Vested | |

| Director Awards Exercised & Vested | | | | Post-Employment Compensation | |

| | | Pension Plans | | | | | Pension Plans | |

| Stock Ownership Information | | Stock Ownership Information | | | Nonqualified Deferred Compensation Plans | |

| Policies on Insider Trading and Hedging | | Policies on Insider Trading and Hedging | | | Employment & Termination Arrangements | |

| | Pay versus Performance | |

| Stock Ownership Information | | |

| Security Ownership by Certain Beneficial Owners | | Other Matters | |

| Security Ownership by Management | | 2024 Annual Meeting—Proposal & Nomination Deadlines | |

| Delinquent Section 16(a) Reports | | | Availability of Annual Report on Form 10-K | |

| Policy on Hedging | | | Pay Ratio of CEO to Median Employee | |

| | Vote Item 1—Election of Directors | |

| Vote Item 1—Election of Directors | |

| Vote Item 1—Election of Directors | Vote Item 1—Election of Directors | | | | | Pay Versus Performance | |

| Board Composition & Processes | Board Composition & Processes | | |

Diversity on our Board (incl'g skills & characteristics matrix) | Diversity on our Board (incl'g skills & characteristics matrix) | | |

Diversity on our Board (incl'g skills & characteristics matrix) | |

Diversity on our Board (incl'g skills & characteristics matrix) | | | | Other Matters | |

| Nominees for Election | Nominees for Election | | | Nominees for Election | | | 2025 Annual Meeting—Proposal & Nomination Deadlines | |

| | | Availability of Annual Report on Form 10-K | | | | | Availability of Annual Report on Form 10-K | |

| | | Pay Ratio of CEO to Median Employee | | | | | Pay Ratio of CEO to Median Employee | |

| | Vote Item 2—Auditor Ratification | | |

| Appointment of Auditors for 2023 | | |

| Auditor Fees Past Two Years | | |

| Pre-Approval Policy for Auditor's Services | | |

| |

| | | | | | | | |

| 1 | 20232024 PROXY STATEMENT |

Proxy Summary

Please read the entire proxy statement before voting. This summary highlights information contained elsewhere in this proxy statement and does not contain all of the information that you should consider. Page references are supplied to help you find further information in the proxy statement.

The Annual Meeting

| | | | | |

| Time and Date | 8:00 a.m. Central Time, April 25, 202323, 2024 |

| Place | The Auditorium of the First Horizon Building, 165 Madison Avenue, Memphis, Tennessee 38103 |

| Record Date | February 24, 202323, 2024 |

| Common Shares Outstanding | 537,356,511554,944,033 common shares were outstanding on the record date and entitled to vote |

| Internet Availability of Proxy Materials | First Horizon uses the SEC’s “notice and access” rule. Notice of internet availability of proxy materials will be sent on or about March 13, 2023.11, 2024. |

| Admission Requirements | To attend the meeting in person you will need proof of your stock ownership such as an appropriate brokerage statement and valid photo identification (or other identification acceptable to the company). If you are the legal representative of a shareholder, you must also bring a letter from the shareholder certifying (a) the beneficial ownership you represent and (b) your status as a legal representative. We will determine in our sole discretion whether the letter presented for admission meets the above requirements. |

|

|

|

|

|

|

Vote Items

| | | | | | | | | | | |

| ITEM | MATTER | BOARD RECOMMENDATION | PROXY PAGE

NUMBER |

| Vote Item 1 | Election of directors. We are asking you to elect the 1413 nominees named in this proxy statement as directors for a one-year term. | FOR each nominee | |

| Vote Item 2 | Ratification of appointment of auditors. We are asking you to ratify the appointment of KPMG LLP as our auditors for 2023.2024. | FOR | |

| Vote Item 3 | Approval of an Amendment to our 2021 Incentive Plan. We are asking you to approve an amendment to our 2021 Incentive Plan to increase the number of shares authorized for issuance as awards under the plan. | FOR | |

| Vote Item 4 | Say on pay advisory resolution on executive compensation. In accordance with SEC rules, we are asking you to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement. | FOR | |

Vote Item 4 | Advisory resolution on the frequency of the say on pay vote. In accordance with SEC rules, we are asking you to vote on how frequently we should seek a say on pay vote in future years (whether every year, every two years or every three years). The Board recommends that you vote for a one-year interval for future say on pay votes.

| FOR

a say on pay vote

every year

| |

ESGPerformance Highlights

2023 was a year of unforeseen events for our company and great challenges for the banking industry. Despite the termination of our previously announced merger with TD Bank, unprecedented events in the banking sector and a difficult economic environment, we met every challenge and continue our 160-year legacy with confidence in a bright future.

Our results in 2023 were driven by two key factors: our strong capital and financial position and our outstanding team. Our capital, prudently managed investments, and diversified liquidity position were fundamental to our ability to serve and support our clients consistently through changing economic conditions.

One of the highlights of our year was our highly successful deposit campaign. Launched in the second quarter, our team attracted more than 32,000 new-to-bank clients and $6 billion in new-to-bank funds with continued deposit momentum

throughout the year. Even as these deposits began to reprice in the fourth quarter, we retained 96% of those clients and funds at year end, indicative of our ability to excel at cultivating long-term client relationships.

Additional performance highlights for the year include:

•We delivered net income available to common shareholders of $865 million, or earnings per share of $1.54, compared to $868 million and $1.53 per share in 2022.

•2023 results benefited from a net $59 million after-tax or $0.11 per share of notable items compared with a net reduction of $82 million or $0.15 per share in 2022.*

•Prudent balance sheet management enabled us to better serve our clients. We grew both loans and deposits at significantly higher rates than the industry, supported by our exceptionally strong capital levels.

•We saw the benefit of our asset-sensitive balance sheet with net interest margin up 32 basis points versus 2022, offsetting the decline in revenue from our countercyclical businesses.

•Our deep-rooted relationships with our clients allowed us to retain over 90% of our client base in 2023. Our clients on average have over nine years of tenure at First Horizon.

•We continue to build on our strong capital levels, ending the year at 11.4%.

•Strong capital levels supported the $650 million common share repurchase program approved by our board in January 2024.

•Strong earnings supported 19% tangible book value per share growth, ending the year at $12.13.

•We announced a commitment of an additional $100 million over three years in technology and process improvements to stay in line with the rapid transformation of digital banking and to assure we have the scalability needed for continued growth.

In May 2023, we announced a $50 million commitment to our communities through the First Horizon Foundation. We deployed approximately $18 million during 2023 to over 1,600 non-profit partners to advance access to financial capital, education, housing, redevelopment and revitalization and health and human services for the most vulnerable members of our communities and to live out our Corporate Responsibility pledge to be "Here for Good" for all our stakeholders.

Our achievements in 2023 were made possible by the talent, dedication and drive of our over 7,300 associates. Critically, given the events that unfolded last year, we successfully retained more than 90% of our associates and 97% of our key leaders in 2023, testifying to the success of our efforts to cultivate a work environment in which every associate has the opportunity to grow and develop both professionally and personally. As we embark on our 160th year in business, we look forward to continuing to deliver exceptional value for our associates, clients, communities and shareholders.

*2023 notable items include pre-tax items of $225 million gain on merger agreement termination and $7 million net gain from a small FHN Financial asset disposition, partially offset by a $68 million FDIC special assessment, $51 million of merger-related expense, $50 million contribution to the First Horizon Foundation, $15 million of expense tied to derivative valuation adjustments related to prior Visa Class-B share sales, $10 million of restructuring costs, and a $6 million loss on equity valuation adjustments. Additionally, 2023 includes after-tax notable items of $35 million consisting of a $59 million benefit related to the resolution of merger-related items offset by $24 million related to the surrender of approximately $214 million in book value of bank owned life insurance policies. 2022 notable items include pre-tax items of $135 million of merger-related expense and $22 million of expense tied to derivative valuation adjustments related to prior Visa Class-B share sales, somewhat offset by a $22 million gain on the sale of the title services business, $16 million gain on equity security investments, and $12 million gain on the sale of mortgage servicing rights. Diluted shares in 2023 and 2022 were 562 million and 566 million, respectively, resulting in a benefit of $0.11 and a reduction of $0.15 per share impact of notable items in 2023 and 2022, respectively.

Corporate Responsibility & Compensation Highlights

In the following tables we provide a high-level summary of selected practices, including statistical data, in environmental, social,the areas of corporate responsibility, governance, and governance (ESG) areas or related to executive compensation. The areas were selected based on feedback we have received from shareholders in recent years.

Board Composition and Governance

| | | | | | | | |

| PRACTICE | FIRST HORIZON | PROXY PAGE NUMBER |

| Number of director nominees | 14 | |

| Independence % of director nominees | 93% (13 of 14) | |

| Independence on key* board committees | 100% | |

| Is there majority voting for directors (in uncontested elections)? | Yes | |

| Must director tender resignation if fails to receive majority vote? | Yes | |

| | PRACTICE | PRACTICE | FIRST HORIZON | PROXY PAGE NUMBER | PRACTICE | FIRST HORIZON | PROXY PAGE NUMBER |

| Number of director nominees | | Number of director nominees | 13 | |

| Independence % of director nominees | | Independence % of director nominees | 92% (12 of 13) | |

| Independence on key* board committees | | Independence on key* board committees | 100% | |

| Is there majority voting for directors (in uncontested elections)? | | Is there majority voting for directors (in uncontested elections)? | Yes | |

| Must director tender resignation if fails to receive majority vote? | | Must director tender resignation if fails to receive majority vote? | Yes | |

| Average director nominee age | Average director nominee age | 66 years | | Average director nominee age | 64 years | |

| Average director nominee tenure | Average director nominee tenure | 8.1 years | | Average director nominee tenure | 8.8 years | |

| Board refreshment | Board refreshment | 8 new directors in the past 5 years | | Board refreshment | 9 new directors in the past 5 years | |

| Does the company disclose a director skills matrix? | Does the company disclose a director skills matrix? | Yes | | Does the company disclose a director skills matrix? | Yes | |

| Gender diversity % of director nominees | Gender diversity % of director nominees | 29% (4 of 14) | | Gender diversity % of director nominees | 38% (5 of 13) | |

| Racial/ethnic diversity % of director nominees | Racial/ethnic diversity % of director nominees | 21% (3 of 14) | | Racial/ethnic diversity % of director nominees | 23% (3 of 13) | |

| Are CEO and Chairman of the Board separate? | Are CEO and Chairman of the Board separate? | No | | Are CEO and Chairman of the Board separate? | No | |

| Is the Chairman of the Board independent? | Is the Chairman of the Board independent? | No | | Is the Chairman of the Board independent? | No | |

| Is there an independent Lead Director? | Is there an independent Lead Director? | Yes | | Is there an independent Lead Director? | Yes | |

| Director terms | Director terms | All directors are elected for a term of one year | | Director terms | All directors are elected for a term of one year | |

| Does the company disclose stock ownership guidelines for directors? | Does the company disclose stock ownership guidelines for directors? | Yes | | Does the company disclose stock ownership guidelines for directors? | Yes | |

| Mandatory retirement age** | Mandatory retirement age** | 72, for non-employee directors | | Mandatory retirement age** | 72, for non-employee directors | |

| Retirement age waivers | Retirement age waivers | Board may waive each year for up to 3 additional terms | | Retirement age waivers | Board may waive each year for up to 3 additional terms | |

| Resignation tender if director has major job change (other than promotion)? | Resignation tender if director has major job change (other than promotion)? | Yes | | Resignation tender if director has major job change (other than promotion)? | Yes | |

| Director nominees on more than two other public company boards | Director nominees on more than two other public company boards | None | | Director nominees on more than two other public company boards | None | |

| Annual Board & committee self-evaluations? | Annual Board & committee self-evaluations? | Yes | | Annual Board & committee self-evaluations? | Yes | |

| Annual individual director evaluations? | Annual individual director evaluations? | Yes | | Annual individual director evaluations? | Yes | |

| Third party engaged to conduct Board and director evaluations? | Third party engaged to conduct Board and director evaluations? | Yes; every 3 years or as determined by the Nominating & Corporate Governance Committee | | Third party engaged to conduct Board and director evaluations? | Yes; every 3 years or as determined by the Nominating & Corporate Governance Committee | |

| Incumbent director attendance at Board & committee meetings | Incumbent director attendance at Board & committee meetings | Average attendance > 97% | | Incumbent director attendance at Board & committee meetings | Average attendance > 96% | |

| Total Board meetings held in 2022 | 9 | |

| Total Board committee meetings held in 2022 | 39 | |

| Total Board meetings held in 2023 | | Total Board meetings held in 2023 | 9 | |

| Total Board committee meetings held in 2023 | | Total Board committee meetings held in 2023 | 41 | |

| Do directors meet in executive session without management? | Do directors meet in executive session without management? | Yes, generally at each regular Board meeting | | Do directors meet in executive session without management? | Yes, generally at each regular Board meeting | |

* Key board committees are Audit, Compensation, and Nominating & Corporate Governance.

* * Under the provisions of our merger agreement with IBERIABANK Corporation, the mandatory retirement provisions willdid not apply to anydirector nominees Barton, Compton, Davidson, Jordan, Kemp, Maples, Palmer, Reed, Stewart, Sugrañes or Taylor from the closing date of the current director nomineesmerger (July 1, 2020) until after the third anniversary of the merger (July 1, 2023).

Shareholder Rights and Governance*

| | | | | |

| AREA | FIRST HORIZON |

| One share, one vote? | Yes |

| Dual or multiple class common stock? | No |

| Cumulative voting of stock? | No |

| Vote required for shareholders to amend Charter | Generally, votes cast favoring exceed votes cast opposing |

| Exceptions to general vote requirement in preceding row | 80% for any provision of charter inconsistent with any provision of bylaws or for Article 12 of charter |

| Vote required for shareholders to amend Bylaws | 80% |

| Shareholder right to act by written consent? | Yes; all shareholders must consent to take action |

| Shareholder right to call a special meeting? | Yes, upon demand of holders of 10% of outstanding common shares |

| Blank-check preferred stock authorized? | Yes |

| Blank-check preferred stock outstanding? | SixFive Series: B, C, D, E, F and GF |

| Outstanding shareholder rights plan? | No |

| Proxy access bylaw? | Yes |

| Exclusive forum bylaw? | Yes |

*See our Amended and Restated Charter and our Bylaws, both available on our website at https://ir.firsthorizon.com (click on “Investor Relations,” then “Corporate Governance,” and then “Governance Documents”), for details.

Other Governance

| | | | | | | | |

| AREA | FIRST HORIZON | PROXY PAGE NUMBER |

| Anti-hedging policy for directors and executives? | Yes | |

| Code of Business Conduct and Ethics? | Yes | |

| Code of Ethics for Senior Financial Officers? | Yes | |

| Compliance and Ethics Program Policy? | Yes | |

| Board oversight of cybersecurity? | Yes, by Risk Committee | |

| Audit committee financial experts? | 23 currently serve on Audit Committee | |

Corporate Responsibility*

Environmental and Social*

| | | | | |

| AREA | FIRST HORIZON |

| Diversity, Equity and Inclusion Program? | Yes |

| Board oversight of environmental, social and governance matters? | Yes, by the Nominating & Corporate Governance Committee |

| Chief Diversity, Equity and Inclusion Officer? | Yes |

| ESG Officer? | Yes |

| Human Rights Statement? | Yes |

| Social Issues Statements? | Yes |

| Code of Conduct for Suppliers? | Yes |

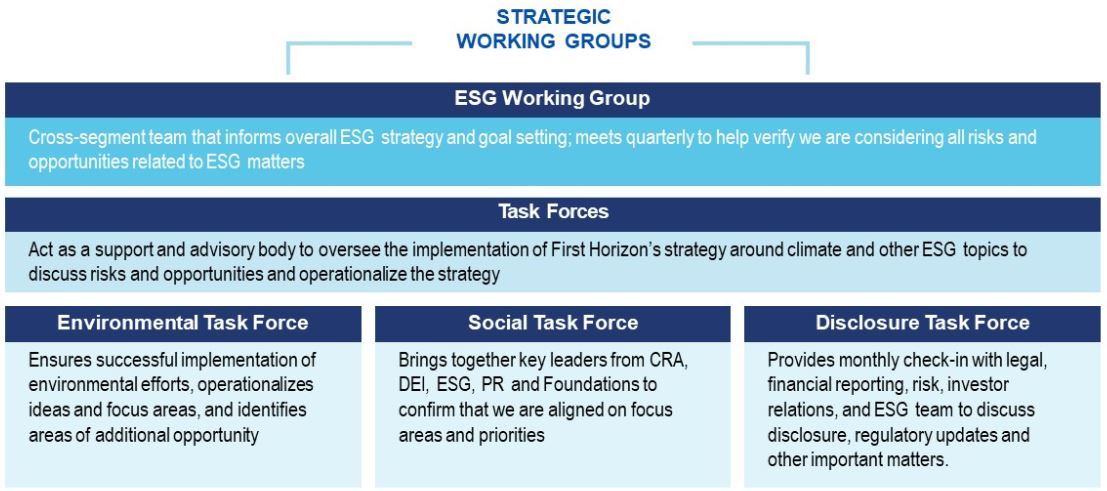

Corporate Social ResponsibilityESG working group and task forces? | Yes |

| Corporate Social Responsibility Report? | Yes--most recently published June 2022 |

*See Environmental, Social & Governance MattersCorporate Responsibility on pages 1011-11-13 of this proxy statement, as well as our Corporate Social Responsibility Report, for additional details.

Executive Compensation

| | AREA | AREA | FIRST HORIZON | PROXY PAGE NUMBER | AREA | FIRST HORIZON | PROXY PAGE NUMBER |

| Independent consultant for the Compensation Committee | Independent consultant for the Compensation Committee | Meridian Compensation Partners, LLC | | Independent consultant for the Compensation Committee | Meridian Compensation Partners, LLC | |

| Frequency of say on pay vote? | Frequency of say on pay vote? | Annual | | Frequency of say on pay vote? | Annual | |

| Clawback policy? | Yes | |

| Clawback policies? | | Clawback policies? | Yes* | |

| Clawback features in award plans? | Clawback features in award plans? | Yes, long-term and annual bonus | | Clawback features in award plans? | Yes, long-term and annual bonus | |

| Below-market options allowed? | Below-market options allowed? | Only in substitution, in a merger, limited to 5% of plan authorization | | Below-market options allowed? | Only in substitution, in a merger, limited to 5% of plan authorization | |

| Stock ownership guidelines for executives? | Stock ownership guidelines for executives? | Yes | | Stock ownership guidelines for executives? | Yes | |

| Executive-level employment agreements? | Executive-level employment agreements? | None | | Executive-level employment agreements? | 1, with the CEO** | |

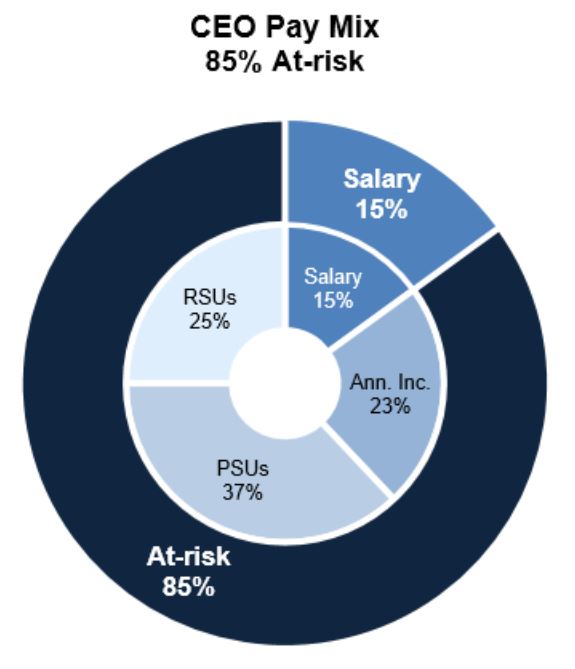

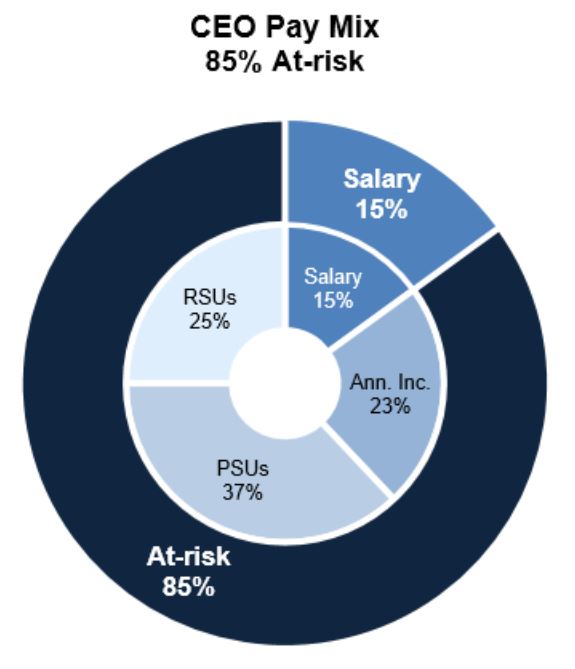

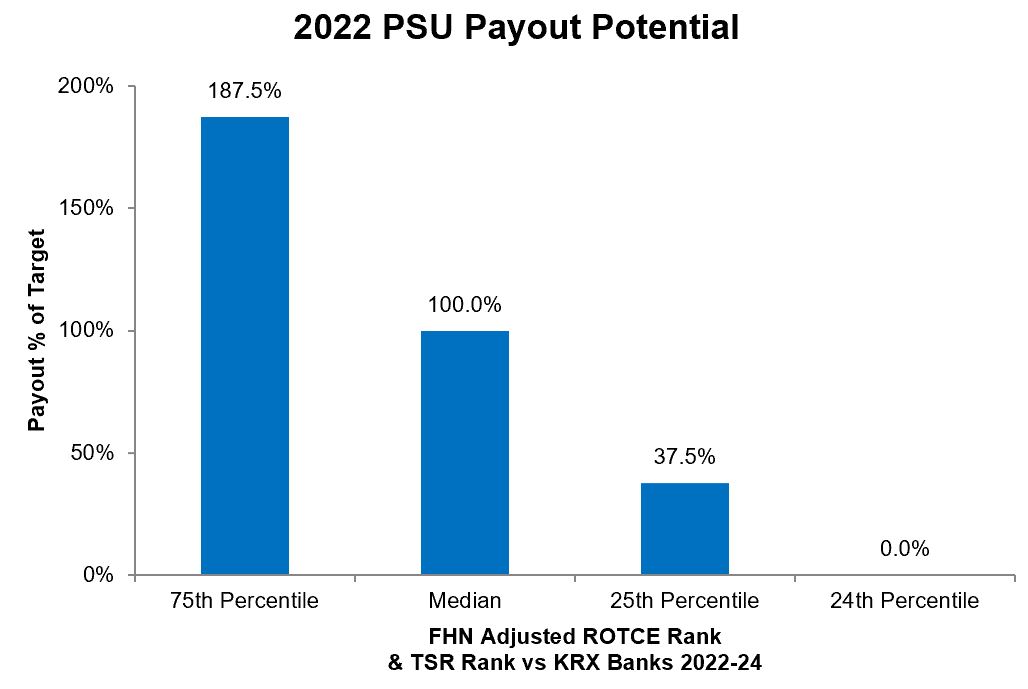

| Portion of CEO's 2022 TDC that is performance-based | 60% | |

| Portion of CEO's 2022 TDC that is stock-based | 62% | |

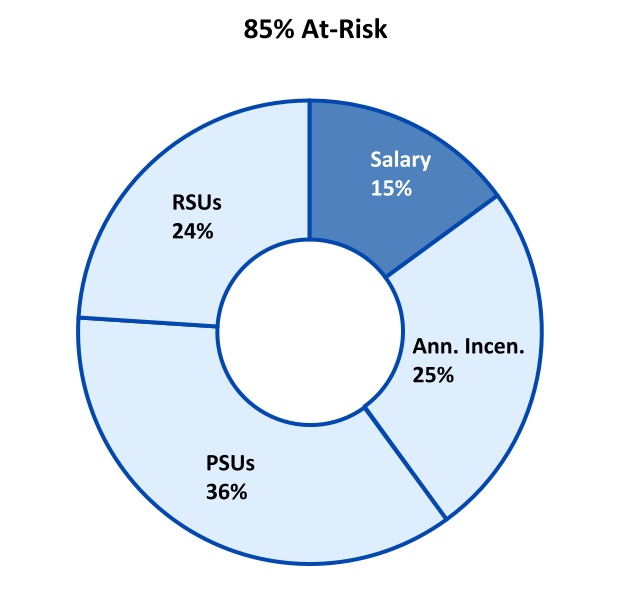

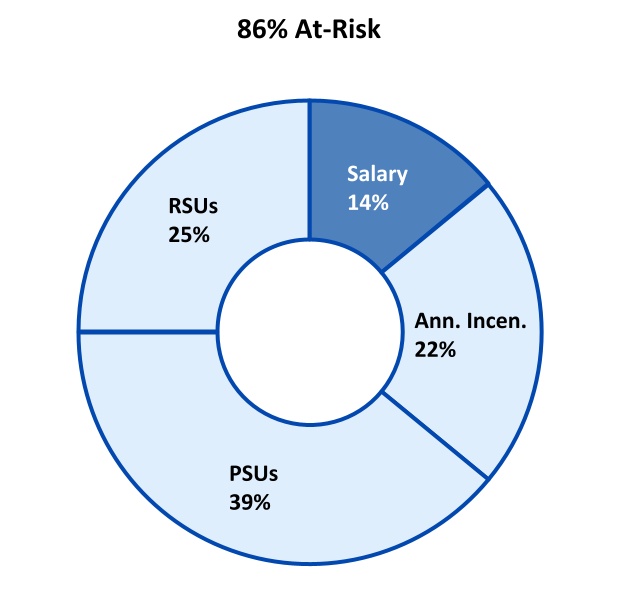

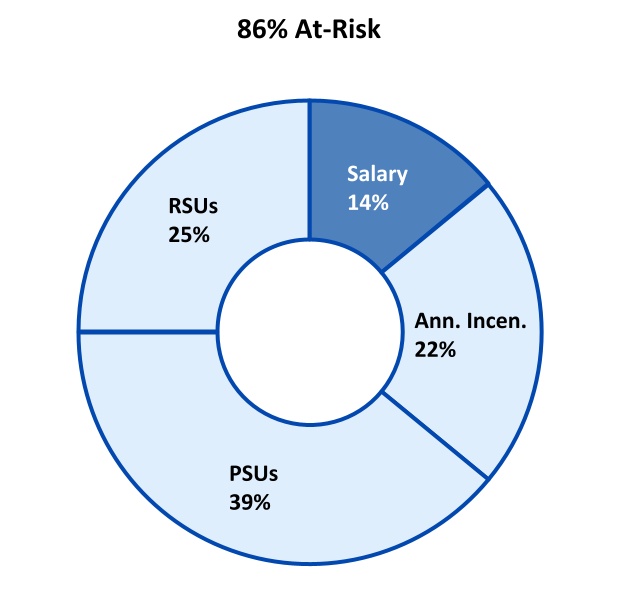

| Portion of CEO's 2023 TDC that is performance-based | | Portion of CEO's 2023 TDC that is performance-based | 61% | |

| Portion of CEO's 2023 TDC that is stock-based | | Portion of CEO's 2023 TDC that is stock-based | 60% | |

| Change in control (CIC) severance program? | Change in control (CIC) severance program? | Yes; new executive plan & legacy agreements | | Change in control (CIC) severance program? | Yes; executive plan & legacy agreements | |

| Single-trigger CIC severance benefits? | Single-trigger CIC severance benefits? | No | | Single-trigger CIC severance benefits? | No | |

| Range of CIC severance benefit | Range of CIC severance benefit | 1.5 to 3.0 times salary & bonus | | Range of CIC severance benefit | 1.5 to 3.0 times salary & bonus | |

| Named Executive Officers in CIC severance program | Named Executive Officers in CIC severance program | 5 out of 6 | | Named Executive Officers in CIC severance program | 5 out of 5 | |

| Tax gross-up paid on CIC severance benefit? | Tax gross-up paid on CIC severance benefit? | Generally no, with one exception from 2007 | | Tax gross-up paid on CIC severance benefit? | No | |

*Our Compensation Recovery Policy and our Erroneously Awarded Compensation Recovery Policy are both available on our website at https://ir.firsthorizon.com (click on “Investor Relations,” then “Corporate Governance,” and then “Governance Documents”).

| | | | | | | | |

| 45 | 20232024 PROXY STATEMENT |

Annual Meeting Matters

Our Board of Directors is soliciting proxies to be voted at our upcoming annual meeting of the holders of First Horizon’s common stock (and at any adjournment or adjournments of the meeting). At the meeting, our common shareholders will act to elect 1413 directors; to approve an amendment to our 2021 Incentive Plan to

increase the number of shares authorized for issuance as awards under the plan; to ratify the appointment of KPMG LLP as our independent auditors for 2023;2024; and to vote on an advisory resolution to

approve executive compensation (“say on pay”); and to approve an advisory proposal to determine the frequency (whether every year, every two years or every three years) of future say on pay votes. If the pending TD acquisition is completed prior to the commencement of the annual meeting on April 25, 2023, the annual meeting will not be held..

Date, Time and Place

The annual meeting of the holders of our common stock will be held on Tuesday, April 25, 202323, 2024, at 8:00 a.m. Central Time in the Auditorium of the First Horizon Building, 165 Madison Avenue, Memphis, Tennessee

38103. To obtain additional information or directions to be able to attend the meeting and vote in person, contact our transfer agent at (877) 536-3558.

What You Will Need to Attend the Meeting in Person

You will need proof of your share ownership acceptable to the company (such as an appropriate brokerage statement if you hold your shares through a broker) and a form of valid photo identification (or other identification acceptable to the company). If you do not have proof of ownership and acceptable identification, you may not be admitted to the Annual Meeting. If you are the legal representative of a shareholder, you must also bring a letter from the shareholder certifying (a) the beneficial ownership you represent and (b) your status as a legal

representative. We will determine in our sole discretion whether the documents presented for admission meet the above requirements.

No cameras, laptops, tablets, recording equipment, large bags, backpacks, briefcases, or similar items are permitted in the meeting room. Cell phones may not be used during the meeting, and we reserve the right to remove individuals who do not adhere to these requirements.

Terms Used in this Proxy Statement

In this proxy statement, First Horizon Corporation is referred to by the use of “we,” “us” or similar pronouns, or simply as “FHN” or “First Horizon,” and First Horizon and its consolidated subsidiaries are referred to collectively as “the company.” First Horizon and IBERIABANK Corporation completed a merger of equals in 2020. IBERIABANK Corporation is referred to in this proxy statement by the use of “IBKC.” The term “shares” means

First Horizon’s common stock, and the term “shareholders” means the holders of that common stock, unless otherwise clearly stated. The term “associates” means persons employed by the company. The notice of the 20232024 annual meeting of shareholders, this proxy statement, our annual report on Form 10-K for the year ended December 31, 2022,2023, and the proxy card are together referred to as our “proxy materials.”

Internet Availability of Proxy Materials

We use the SEC’s “notice and access” rule, which allows us to furnish our proxy materials over the internet to our shareholders instead of mailing paper copies of those materials to each shareholder. As a result, beginning on or about March 13, 2023,11, 2024, we sent to most of our shareholders by mail or email a notice of internet availability of proxy materials, which contains instructions on how to access our proxy materials over the internet

and vote online. This notice is not a proxy card, and you

cannot use it to vote your shares. If you received only a notice, you will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the notice.

If you received a paper copy of the notice, we encourage you to help us save money and reduce the environmental

impact of delivering paper notices by signing up to receive all of your future proxy materials electronically.

If you own shares of common stock in more than one account—for example, in a joint account with your spouse and in your individual brokerage account—you may have

received more than one notice. To vote all of your shares,

please follow each set of separate voting instructions that you received for the shares of common stock held in each of your different accounts.

Voting by Proxy & Revoking Your Proxy

The First Horizon Board of Directors is asking you to give us your proxy. Giving us your proxy means that you authorize another person or persons to vote your shares of our common stock at the annual meeting of shareholders in the manner you direct. Giving us your proxy allows your shares to be voted even if you do not attend the annual meeting. You may revoke your proxy at any time before it is exercised by writing to the Corporate Secretary, by timely delivering a properly executed, later-dated proxy (including by telephone or internet) or by voting by ballot at the meeting. All shares represented by valid proxies received pursuant to this solicitation, and not revoked before they are exercised, will be voted in the manner specified on the proxy. If you submit a proxy without giving specific voting instructions, your shares

will be voted in accordance with the recommendations of our Board of Directors as follows:

FOR:

1. Election of 1413 directors to serve until the 20242025 annual meeting of shareholders and until their successors are duly elected and qualified.

2. Ratification of the appointment of auditors.KPMG LLP as our auditors for 2024.

3. Approval of an amendment to our 2021 Incentive Plan to increase the number of shares authorized for issuance as awards under the plan.

4. Approval of an advisory resolution to approve executive compensation ("say on pay").

4. Approval of an advisory proposal to determine the frequency (whether every year, every two years or every three years) of future say on pay votes.

Solicitation of Proxies

First Horizon will pay the entire cost of soliciting the proxies. In following up the original solicitation of the proxies, we may request brokers and others to send proxy materials to the beneficial owners of the shares and may reimburse them for their expenses in so doing. If we deem it necessary, we may also use several of our associates to solicit proxies from the shareholders, either personally or by telephone, letter or email, for which they will receive

no compensation in addition to their normal compensation. We have hired Morrow Sodali LLC, 333 Ludlow Street, Fifth Floor, Stamford, CT 06902 to aid us in the solicitation of proxies for a fee of $9,000$10,000 plus out-of-pocket expenses. An additional charge of $6.50 per holder will be incurred should we choose to have Morrow Sodali LLC solicit individual holders of record.

Quorum & Vote Requirements

Except for our depositary shares (each representing a fractional interest in a share of one of our series of non-cumulative perpetual preferred stock, Series B, C, D, E or F) and our non-cumulative perpetual preferred stock, Series G,, all of which have limited voting rights and no right to vote at the annual meeting, our common stock is our only class of voting securities. There were 537,356,511554,944,033 shares of common stock outstanding and entitled to vote as of February 24, 2023,23, 2024, the record date for the annual meeting.

Each share is entitled to one vote. A quorum of the shares must be represented at the meeting to take action on any matter at the meeting. A majority of the votes entitled to be cast constitutes a quorum for purposes of the annual meeting. Both “abstentions” and broker “non-votes” will

be considered present for quorum purposes, but will not otherwise have any effect on the vote items.

The affirmative vote of a majority of the votes cast is required to elect the nominees as directors, and we have adopted a director resignation policy that requires a director who does not, in an uncontested election, receive the affirmative vote of a majority of the votes cast with respect to his or her election to tender his or her resignation. For additional information on our director resignation policy, see the summary of the policy under Director Resignation and Retirement Policies in vote item 1 of this proxy statement, which begins on page 3436. The policy is also contained in our Corporate Governance Guidelines, which are available on our website at https://ir.firsthorizon.com (click on “Investor Relations,” then “Corporate G

overnance,Governance,” and then “Governance Documents”). The affirmative vote of a majority of the votes cast is required to approve the advisory resolution on executive

compensation, to approve on an advisory basis the framendment to the 2021 Incentive Plan to increase the number of

equency of future say on pay votes,shares authorized for issuance as awards under the plan, and to ratify the appointment of auditors.

Effect of Not Casting Your Vote

Shares Held in Street Name. If you hold your shares in street name it is critical that you instruct your broker or bank how to vote if you want your vote to count in the election of directors, the vote on approval of the amendment to our 2021 Incentive Plan to increase the number of shares authorized for issuance as awards under the plan, and the advisory resolution to approve executive compensation and the advisory proposal to determine the frequency of future say on pay votes (vote items 1, 3 and 4 of this proxy statement). Under current regulations, your broker or bank will not have the ability to vote your uninstructed shares in these matters on a discretionary basis. Thus, if you hold your shares in street name and you do not instruct your broker or bank how to vote, no votes

will be cast on your behalf with respect to these matters. Your broker or bank will have the ability to vote uninstructed shares on the ratification of the appointment of auditors (vote item 2).

Shareholders of Record. If you are a shareholder of record and you do not vote your proxy, no votes will be cast on your behalf on any of the items of business at the annual meeting unless you attend the annual meeting and vote your shares there.

Duplicate Mailings & Householding

Duplicate mailings in most cases are inconvenient for you and an unnecessary expenditure for us. We encourage you to eliminate them whenever you can as described below.

Multiple Accounts. Some of our shareholders own their shares using multiple accounts registered in variations of the same name. If you have multiple accounts, we encourage you to consolidate your accounts by having all your shares registered in exactly the same name and address. You may do this by contacting our stock transfer agent, Equiniti Trust Company (EQ), by phone toll-free at 1-877-536-3558, or by mail to EQ Shareowner Services, P.O. Box 64854, St. Paul, MN 55164-0854.

Shares Held in Street Name. If you and other members of your household are beneficial owners of shares, meaning that you own shares indirectly through a broker, bank, or other nominee, you may eliminate any duplication of mailings by contacting your broker, bank, or other nominee. If you have eliminated duplicate mailings but for any reason would like to resume them, you must contact your broker, bank, or other nominee.

Shareholders with the Same Address; Requesting Changes. If you are among the shareholders who receive paper copies of our proxy materials, SEC rules allow us to mail a single copy of those materials to all shareholders residing at the same address if certain conditions are met. This practice is referred to as "householding." Householding does not apply to either the proxy card or the notice of internet availability of proxy materials. If your household receives only one copy of the proxy materials and if you wish to start receiving separate copies in your name, apart from others in your household, you

must request that action by contacting our stock transfer agent, EQ, by phone toll-free at (877) 536-3558 or by writing to EQ Shareowner Services, Attn: Householding, P.O. Box 64854, St. Paul, MN 55164-0854. That request must be made by each person in the household who desires a separate copy. Within 30 days after your request is received we will start sending you separate mailings. If you and members of your household are receiving multiple copies and you want to eliminate the duplications, please request that action by contacting EQ using the contact information given in this paragraph above. In either case, in your communications, please refer to your account number. Please be aware that if you hold shares both in your own name and as a beneficial owner through a broker, bank or other nominee, it is not possible to eliminate duplications as between these two types of ownership. If your household receives only a single copy of the proxy materials, and if you desire your own separate copies for the 20232024 annual meeting, you may download them from our website using the website address listed in the box below. If you would like additional copies mailed, we will mail them promptly if you request them from our Investor Relations department at our website or by mail to Investor Relations, P.O. Box 84, Memphis, TN 38101. You may also request that additional copies be mailed by calling our transfer agent at (877) 536-3558. However, we cannot guarantee you will receive mailed copies before the 20232024 annual meeting.

| | | | | | | | |

| 78 | 20232024 PROXY STATEMENT |

| | |

Important Notice Regarding Availability of Proxy Materials for the Shareholder Meeting to be held on April 25, 202323, 2024 |

This proxy statement, our proxy card, and our annual report on Form 10-K are available at https://ir.firsthorizon.com/annual-reports/. www.proxydocs.com/FHN.

Also available there is a letter to shareholders discussing our 20222023 activities and performance. |

Culture & Governance

Our Firstpower Culture

HavingFor the past 160 years, our culture has been a strongcatalyst to our success. Our culture is mission criticalcentered around our people and their performance, promoting teamwork and collaboration to achieve results. We prioritize a healthy work environment, which enhances morale and associate satisfaction, ultimately leading to increased productivity and engagement. In 2023, we retained 90% of our associate base, including nearly 97% of our key leaders, indicative of our ability to attract and retain top talent and achieve long-term success. Our culture - whicheven in challenging circumstances.

At the center of all that we call Firstpower - is grounded indo are our corporate purpose and values and helps guide the manner in which we operate our business, serve our clients, care for our associates and communities and perform for our shareholders.

Our Purpose, Values and Commitment, capture who we are today and aspire to be going forward. We holdholding ourselves to the highest standards of ethical conduct and that means doing what is right for our business, our associates, the environment and our communities.operational excellence.

Our Purpose: To help our clients unlock their full potential with capital and counsel.

Our Values:

▪Put Clients First – Go above and beyond to listen, understand and solve the client’s needs. Follow through and exceed expectations every step of the way.

▪Care About People – Treat others with respect and dignity. Foster a culture of collaboration. Demonstrate kindness and empathy for all.

▪Commit to Excellence in Everything We Do – Conduct business with professionalism and dignity. Embody a “can do” spirit that gets results for our clients.

▪Elevate Equity – Place equityProviding fair and equitable opportunities for associates is at the center of our diversity and inclusion efforts. Create accountability and ensure accessibility and opportunity for all.

▪Foster Team Success – Measure wins in terms of “we” not “me.” Take pride in company success. Be invested in a shared vision for future growth.

Commitment: As teammates and as individuals, we must own the moment. We listen, understand and deliver.

In 2022, the strength of our purpose-driven, collaborative culture was instrumental to our success. While continuing to operate a hybrid work environment, we not only achieved our performance objectives but completed our

merger-of-equals systems conversion and made significant strides in preparing for our pending acquisition by TD.

Our culture must evolve to reflectUnderstanding the changing needs and expectations of our workforce. workforce is central to our success. As evidenced

during the pandemic, our ability to remain nimble and responsive allows us to serve our clients and communities without disruption even when business conditions change.

We want our associates to be inspired by the work we do and empowered to perform at their best. As we have for many years, we provided opportunities for associates to provide feedback includingWe seek their input through formal surveys and through the Firstpower Council. UsingCouncil, a varietygroup of toolsassociates representing various areas of the company that provide direct feedback on opportunities to enhance our culture and resources, we also continuedorganizational effectiveness.

The overall well-being of every associate is important to offerus. In addition to competitive health care benefits, wellness programs mentoring, internships, volunteerism, informal shout-outs and formal recognitions, career management and continuing education, associate resource groups, parental and care-giver support, we offer professional development opportunities through mentoring and career development programs. Associates can actively engage with their colleagues at work and be involved in the community in a variety of ways, including through volunteerism and by participating in one or more of our associate resource groups (of which there are 10, with two additional groups set to support our associates’ personallaunch in 2024).

Creating a diverse workforce and professional health and development.

An integral partinclusive work environment is a fundamental aspect of our Firstpower culture is our unwavering commitment to diversity, equity, and inclusion.culture. This commitment starts at the top - as our corporateof the organization with Board of Directors oversees the company’s DEI strategyoversight and receives periodic reports from management on DEI efforts –executive leadership support and is embedded throughout our organization.organization and business priorities.

Our objective is not only to attract a diverse team, but also to create an environment in which different backgrounds, opinions and perspectives are valued. With an emphasis on elevating equity, we hold our company accountable for quantifying and reducing disparities in accessibility and opportunity based on gender, age, socioeconomic status, sexual orientation, disability status, veteran status, and race/ethnicity. We elevate equity through:continuously focus on:

▪EnsuringActively seeking representation of diverse talent

▪Strengthening leadership capabilities and accountability

▪Fostering inclusion and equality through fairness and transparency

▪Better serving diverse markets and clients

▪Investing in the well-being of communities

| | | | | | | | |

| 89 | 20232024 PROXY STATEMENT |

▪Investing in the well-being of communities

▪Our 10 commitments, which include providing DEI specific trainingexpanding outreach and providing access to capital for historically underserved groups

We made measurableIn 2023, we continued to make progress in 2022 with the addition of diverse candidatesdiversity in leadership roles, the launch oflaunched new Associate Resource Groups greater use of metrics to gauge our progress and the release ofreleased a new Corporate Diversity Statement.

We remain committed to creating a more equitable society, and that starts with our associates, our clients, and the communities we serve. We do this by elevating equity, providing capital and counsel and committing to excellence in everything we do. The full Board oversees the company’s DEI strategy and receives periodic reports from management on our DEI efforts.

At December 31, 2022,2023, First Horizon had:

▪7,5427,378 associates, or 7,3977,249 full-time-equivalent and 144129 part-time-equivalent associates, not including contract labor for certain services:

◦68% 66% white, 19%20% African American, 9% Hispanic, 3% Asian, and 1%2% other races or ethnicities

◦63% female and 37% male

◦3%4% have disabilities

•1,2091,200 corporate managers:

◦78%76% white, 12%13% African American, 7% Hispanic, 2% Asian, and 1% other races or ethnicities

◦54% female and 46% male

◦1%2% have disabilities

•2736 members of the CEO's Operating Committee (composed of the CEO and senior leaders from across the organization):

◦78%86% white, 19%11% African American, 0% Hispanic, 4%3% Asian, and 0% other races or ethnicities

◦48%44% female and 52%56% male

Our Awards

First Horizon strives to strengthen the lives of our associates, clients and communities. We’reWe are honored by the recognition awarded us for our efforts. We are especially proud of the praise we have received for our community service, diversity, equity and inclusion efforts, and family-friendly work environment. Here are some of the honors we'vewe have received in the past two years:

| | | | | |

| |

America's Best Banks List America's Best-In-State Banks America's Best Large Employers Best Employers for Women Forbes Magazine | Top 100 Banks in the U.S. GOBanking Rates |

| Corporate Equality Index11 Middle Market Awards

Human Rights Campaign12 Small Business Banking Awards

Greenwich Coalition |

Most Powerful Women in Banking Top TeamTo Watch American Banker | |

| 100 Best Adoption-Friendly Workplaces in AmericaCustomer Experience Extraordinaire

Dave Thomas Foundation for AdoptionWebEx One Champion Awards

|

DEI Leadership AwardBest Companies for Market Outreach StrategiesPeople of Color to Advance

Mortgage Bankers AssociatesBest Companies for Women to Advance

Parity.org Parity LIST | |

| Bloomberg Gender Equality Index Bloomberg |

| Best Companies for Multicultural Women

Working Mother Magazine

|

| |

| |

| | | | | | | | |

| 910 | 20232024 PROXY STATEMENT |

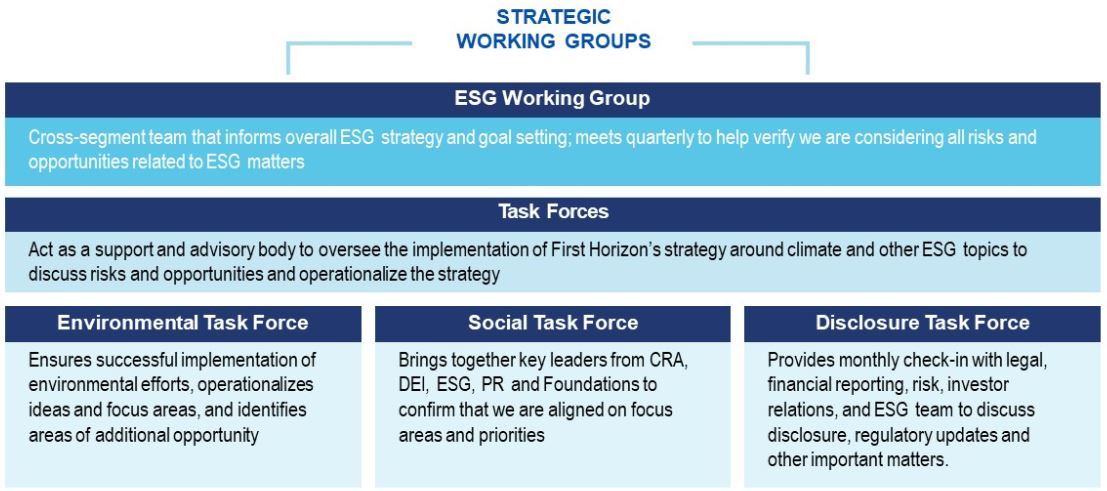

Environmental, Social & Governance MattersCorporate Responsibility

AsOperating responsibly and creating a more sustainable company is important to the worldgrowth and future of our organization. Our corporate responsibility strategy continues to changeencompass environmental, social and governance (ESG) priorities for our company grows, the role we playstakeholders and evolve in supporting sustainable economic growthresponse to a dynamic operating environment.Our strategy remains centered around five interrelated pillars – Governance, Associates, Clients, Communities and societal progress remains critically important.Environment. We continue to enhanceengage with our ESGadvisors, including a climate scientist, and our peers and to track

regulatory progress and momentum. We recently conducted a stakeholder assessment that will help keep us better informed and guide our strategy as described inwe navigate the chart on the following pages. We recognize thatchanging landscape.

Our Nominating & Corporate Governance Committee has oversight responsibility for First Horizon's management of and commitment to environmental, social and governance

matters and reporting, transparentlywhile management is responsible for execution of our initiatives in this area. Management provides updates on ESG performancematters to the Nominating & Corporate Governance Committee at each regularly scheduled Committee meeting. ESG priorities are implemented through the efforts of our ESG Officer, who has primary day-to-day responsibility for ESG matters, as well as through the efforts of the ESG working group and progress is integraltask forces. Moving into 2024 and beyond, we intend to creating confidence for our stakeholders. Our primaryfocus on qualitative and quantitative measurements to monitor ESG goals areprogress; to continue to improve what we already do wellengage with advisors, including a climate scientist, to operationalize solutions; and enhance other areas in line with industry expectations to create long-term value.incorporate climate risk throughout our risk management processes and policies. The chart below lays out our ESG governance structure:

ESG

Corporate Responsibility - Progress and Opportunities

| | | | | |

| |

Recent Progress2023 Accomplishments | Opportunities in Progress and on the Horizon |

Governance |

|

Strategy. Developed focus areas aligned with ESG strategy and pillars.

| Measurement. Focus on qualitative and quantitative measurements to monitor ESG progress.

Implementation. Continue to engage with advisors, working group and task forces to operationalize solutions.

Risk management. Incorporate climate risk throughout our risk management processes and policies.

|

Responsibility.

•Provided regular updates on ESG to the Nominating & Corporate Governance Committee.

•Incorporated climate risk into statement of risk appetite and provided regular updates on climate-related risks and opportunities to the Risk Committee.

•Delegated management responsibility to an ESG Officer.

•Operationalized ESG priorities through efforts of ESG Officer, Corporate Social Responsibility working group and CSR task forces.

•Retained two ESG advisors, including a climate scientist, to help guide our strategy.

|

| Environmental | |

Roadmap. Followed our roadmap and framework to achieve sustainability goals. | GHG Emissions

• Continue to monitor and calculate our Scope 1 and 2 emissions and set reduction targets.

• Focus on understanding and measuring the Scope 3 emissions specific to our financed portfolio, and evaluate various methodologies, including the one developed by the Partnership for Carbon Accounting Financials (PCAF).

Environmental initiativesInitiatives • Continue to work with environmental task force, corporate properties and procurement to assess cost save opportunities and identify measures to improve the resource efficiency of our footprint and activities. • Focus on community restoration, achieved through nature-based projects and strategic relationships.relationships, with an emphasis on coastlines and waterways in our footprint. •Enhance understanding of scenario analysis and Scope 3 reporting with the help of advisors and RMA's Climate Risk Consortium. •Continue partnership with Woods Hole Oceanographic and OCIA for opportunities and ocean-based, science-backed climate change solutions. •Focus on sustainable finance framework/opportunities.

|

Accomplishments •Calculated and reportedAs of 2022, 32% reduction in Scope 1 &2 (unaudited) location-based GHG emissions using 2019 as baseline year. • Conducted monthlyfrequent environmental task force meetings. • Conducted initialRefreshed loan portfolio analysis looking at physical and transition risks and opportunities. • Conducted internal natural hazard risk review of real estate secured collateral in commercial portfolio using FEMA’s risk index.Responded to Carbon Disclosure Project questionnaire. • Piloted an environmental risk tabletop exercise with key leaders across the organization.Joined Risk Management Association Climate Risk Consortium. • ReducedCarried out internal discussions on a sustainable finance framework and eliminated certain products internally for more responsible resource use. • Joined Ocean and Climate Innovation Accelerator (OCIA) • Supported environmental, community and nature-based projects, including a Blue Carbon database.portal.

|

| | | | | |

| |

Recent Progress | Opportunities in Progress and on the Horizon |

| Social | |

DEI •ExpandedContinued to be recognized by organizations such as Bloomberg, Forbes, American Bank and Parity.org for our DEI team.efforts. • Launched the ELEVATE Executive Sponsorship Program. • Created a talent pipeline tool to proactively recruit and retain top talent. • Implemented a best practices guide to help hiring leaders broaden the search for highly qualified talent. • Increased ARG participation to 18.7% of total associate population. Community Investment/Philanthropy •Launched enterprise-wide DEI Council.Refreshed Community Investment Strategy. •Committed Announced $50 million commitment to communities. • $17.8 million distributed to nonprofits from the CEO Action for Diversity & InclusionTM.First Horizon Foundations in 2023. •Launched three new Associate Resource Groups (ARGs): Asian Pacific WAVE, Create and Inspire, and Neurological Diversity Awareness; launched two new chapters Over 27,000 hours of the Women's Initiative ARG in Louisiana and Florida. •Launched Elevating Equity campaign and associate learning series to familiarizeservice performed by associates with DEI concepts.

•Established new reporting procedures to help proactively identify and recruit diverse talent.

•Between October 2021 and October 2022, the number(inclusive of associates who identify as having a disability increased by 41%CRA service hours).

•Created a recruitment guide on how to source, screen, and interview qualified candidates from diverse or underrepresented backgrounds.

CRA •Received an overall rating$9 million of "Satisfactory" during our most recent CRA performance evaluation, with the lending2023 funds dedicated to low- and service tests rated "High Satisfactory" and the investment test rated "Outstanding."moderate -income communities. •Continued to support financial literacy through Operation HOPE, Junior Achievement, and other programs. •20222023 CRA service hours totaled nearly 13,000.over 15,000.

Wellness & Benefits. Continued to provide tools, resources and support to promote associates’ financial, emotional and physical well-being. | Elevate Equity •Launch a new Executive DEI Council to increase awareness and engagement with DEI strategy by the executive management committee. •Launch two ARGs focused on elevating equity in age (GenNow) and familial status (Working Parents and Caregivers) •Create a new DEI-specific sales award.

Culture. Continue to work toward infusing DEI into our programsa collaborative workplace culture, allowing each associate to thrive and activities, internallygrow professionally and externally.personally.

Talent. Focus on increasingidentifying and developing underrepresented talent in key business units and leadership roles.talent.

Community Investment. Socialize new community investment strategy throughout the organization.

CRA. Work to expand access to housing for LMI individuals, support economic development and community revitalization in LMI communities, and improve financial capability and stability in LMI communities. Focus on compliance with new CRA modernization rule. |

| | | | | |

| |

| 2023 Accomplishments | Opportunities in Progress and on the Horizon |

| Engagement and Disclosure | |

Associate Engagement.Stakeholder Assessment. Developed associate education and engagement practices around ESG.

CSR/ESG Impact Report

•Further enhanced transparency of ESG reporting by aligning with SASB and TCFD frameworks.

•Published comprehensive report enhancing qualitative and quantitative metrics.

•Communicated focus areas and progress.

• Expanded Governance and Risk Management section.

• Included strategy and metrics and targets in environmental section.

• Disclosed loan portfolio analysis on climate risk exposure.

| Materiality assessment. Intend to conduct ESG materialityConducted a stakeholder assessment with oura third-party vendor looking at both 1) how key ESG issues impact First Horizon’s business and 2) how First Horizon’s activities impact its stakeholders and which ESG topics are most important to help us prioritize timethem. Assessment drew on multiple inputs, including competitive benchmarking, desk research and resources.interviews with over 20 internal and external stakeholders.

SASB/TCFDFrameworks. . ContinueContinued to review and enhance and update disclosure alignedareas to align with SASB and TCFDvoluntary reporting frameworks.

ESG Ratings. Conducted a rating agency gap analysis to identify disclosure gaps.

| Stakeholder Assessment. Review data and feedback from the assessment to refine areas of focus and identify risks and opportunities.

Associate Education. Enhance materials and create resource page for sustainability initiatives and matters.

Disclosure. Continue to stay engaged with climate and sustainability working groups and follow regulatory movements and guidance. Plan to publish an updated Corporate Social Responsibility and Environmental, Social, Governance Impact Report in mid-2024.

ESG Ratings. Continue to review and update rating organizations' data and enhance reporting where appropriate in order to improve scores and transparency further.

|

Shareholder Engagement

Dialogue with our shareholders is a critical part of our company's success. To remain aligned with the investor community, in 2023 we continued to reach out to our shareholders proactively to solicit their feedback and perspectives on a variety of topics. In addition to hosting an investor day in June 2023, we engaged with

shareholders through investor meetings, sell-side conferences, earnings calls and non-deal roadshows. We also solicited feedback from shareholders on the relative importance to them of various ESG topics as part of the stakeholder assessment discussed in the table above.

Corporate Governance

First Horizon is dedicated to operating in accordance with sound corporate governance principles. We believe that these principles not only form the basis for our reputation of integrity in the marketplace but also are essential to our

efficiency and overall success. Some of our corporate governance principles, policies and practices are highlighted below.

Key Corporate Governance Documents

Our Board has adopted the following key corporate governance documents. All of these are available, along with several other governance documents, such as our compensation recovery policy,policies, stock ownership guidelines, and committee charters, on our website at https://ir.firsthorizon.com (click on “Investor Relations,”

then “Corporate Governance,” and then “Governance Documents”). Paper copies are also available to shareholders upon request to the Corporate Secretary.

Corporate Governance Guidelines. The Guidelines provide our directors with guidance as to their legal

accountabilities, promote the functioning of the Board and its committees, and establish a common set of expectations as to how the Board should perform its functions.

Code of Business Conduct and Ethics. This code sets forth the overarching principles that guide the conduct of every

aspect of our business. Any waiver of the Code of Business Conduct and Ethics for an executive officer or director must be promptly disclosed to shareholders in any manner that is acceptable under the NYSE listing standards, including but not limited to distribution of a press release, disclosure on our website, or disclosure on Form 8-K.

Code of Ethics for Senior Financial Officers. This code promotes honest and ethical conduct, proper disclosure of financial information and compliance with applicable

governmental laws, rules and regulations by our senior financial officers and other associates who have financial responsibilities. We intend to satisfy our disclosure obligations under Item 5.05 of Form 8-K related to amendments or waivers of the Code of Ethics for Senior Financial Officers by posting such information on our website.

Compliance and Ethics Program Policy. We have also adopted a Compliance and Ethics Program Policy, which highlights our commitment to having an effective compliance and ethics program by exercising due diligence to prevent and detect criminal conduct and otherwise by

promoting an organizational culture that encourages ethical conduct and a commitment to compliance with the law.

Related Party Transaction Procedures

The Audit Committee of the Board has adopted procedures for the approval, monitoring, and ratification of transactions between First Horizon, on the one hand, and our directors, executive officers or 5% shareholders, their immediate family members, their affiliated entities and their immediate family members’ affiliated entities, on the other hand. A copy of our procedures is available on our website at https://ir.firsthorizon.com (click on “Investor Relations,” then “Corporate Governance,” and then “Governance Documents”). Our procedures require management to submit any proposed “related party transaction” (defined as a transaction that is required to be disclosed in our proxy statement pursuant to the requirements of Item 404(a) of Regulation S-K promulgated by the SEC) or amendment to an existing related party transaction to the Audit Committee for approval or ratification. In some cases, the matter may be determined by the chair of the Audit Committee. In considering whether to approve a given transaction, the Audit Committee (or chair) must consider:

•whether the terms of the related party transaction are fair to First Horizon and at least as favorable as

would apply if the other party was not, or did not have an affiliation with, a director or executive officer of First Horizon;

•whether First Horizon is currently engaged in other related party transactions with the related party at issue or other related parties of the same director or executive officer; whether there are demonstrable business reasons for First Horizon to enter into the related party transaction; whether the related party transaction would impair the independence of a director; and

•whether the related party transaction would present an improper conflict of interest for any director or executive officer of First Horizon, taking into account the size of the transaction, the overall financial position of the director or executive officer, the direct or indirect nature of the interest of the director or executive officer in the transaction, the ongoing nature of any proposed relationship, and any other factors the Audit Committee deems relevant.

Transactions with Related Persons

First Horizon, the Bank and the subsidiaries of each, as applicable, have entered into lending transactions and/or other banking or financial services transactions in the ordinary course of business with our executive officers, directors, nominees, their immediate family members and affiliated entities, and the persons of which we are aware that beneficially own more than five percent of our common stock, and we expect to have such transactions in the future. Such transactions were made in the ordinary course of business, were made on substantially the same

terms, including interest rates and collateral, as those

prevailing at the time for comparable transactions with persons not related to the company, and did not involve more than the normal risk of collectability or present other unfavorable features. We note that as a perquisite we offer all associates discounts on certain financial services (for example, no-fee domestic wire transfers). These discounts are available to our executive officers except in relation to credit extended at the time an executive officer is serving as such.

| | | | | | | | |

| 1214 | 20232024 PROXY STATEMENT |

Board Matters

In accordance with our Bylaws, First Horizon is managed under the direction of and all corporate powers are exercised by or under the authority of our Board of Directors. Our Board of Directors currently has 1415

members. All of our directors are also directors of First Horizon Bank (the “Bank”). The Bank is our principal operating subsidiary.

Independence & Categorical Standards

Independence

Our common stock is listed on the New York Stock Exchange. The NYSE listing standards require a majority of our directors and all of the members of the Audit, Compensation, and Nominating & Corporate Governance Committees of the Board of Directors to be independent as defined in the listing standards. Under these standards, our Board of Directors is required to determine affirmatively that a director has no material relationship with the company for that director to qualify as independent. In order to assist in making independence determinations, the Board, upon the recommendation of the Nominating & Corporate Governance Committee, has adopted the categorical standards set forth below. In making its independence determinations, each of the Board and the Nominating & Corporate Governance Committee considered the relationships between each director and the company, including those that fall within the categorical standards. In addition, the NYSE listing standards require that the Board specifically consider certain factors in determining the independence of any director who will serve on the Compensation Committee. These factors are described under the heading The

Compensation Committee—In General below in this proxy statement. Our Board specifically considered such factors in making the independence determinations for all of our directors, including those who serve on the Compensation Committee. Based on its review and the application of the categorical standards, the Board, upon the recommendation of the Nominating & Corporate Governance Committee, determined that all 1314 of our